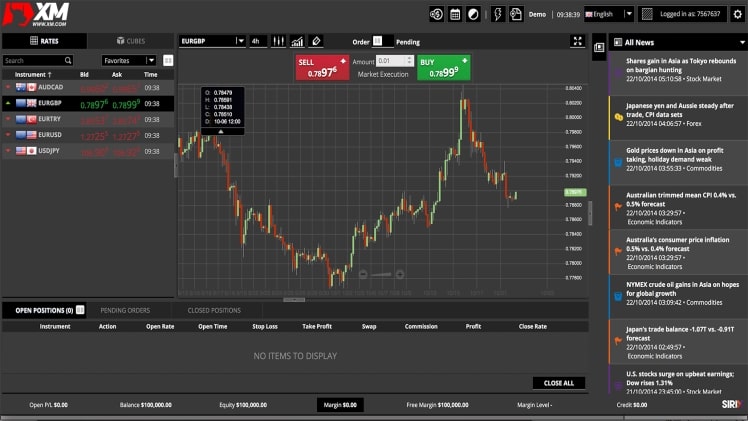

XM broker review , which promotes itself as the “next generation broker” for foreign exchange (FX) and commodity (commodity) trading online. Before opening a live account, investors can get their feet wet with a $100,000 virtual trading account on the trading software’s trial account platform. The features that make this broker service stand out include the ability to trade automatically, the absence of hidden costs or charges, and the lightning-fast order executions. In this 2022 XM review, we take a look at account types and know is copy trading profitable

What does low deposit with XM?

All XM Accounts (Micro, Standard, XM Zero, and XM Ultra Low) have the exact low minimum deposit requirement of just $5.

Types of XM Accounts

When opening an account with XM, a leading forex broker in many countries worldwide, you’ll have several options. To better acquaint you with the various account options, we have provided the following additional details:

· Demo Account

A practice account with XM is a great way to get acquainted with the broker and the trading process. Among the most notable features of XM, trial accounts are the immensity of the trial period. A single email address can be used to create a maximum of five XM demo accounts. All other account types can be tried for free except for the XM Shares Account.

Demo and paid XM subscriptions are identical in every significant respect. There is still plenty of choice in the market. If you don’t live in the areas under the jurisdiction of the Cyprus Securities and Exchange Commission (CySEC), you can also receive a $30 XM bonus.

· Standard Account

Every XM service region offers a basic XM account. Spreads start at one pip, and you can leverage up to 1:500 with XM (or 1:30 in the European Union and Australia) using this account. Trading is also free of charge with the XM regular account.

· Micro Account

In addition, the XM micro account is accessible worldwide, offering the same low spreads (from 1 pip) and commission-free transactions. Reduce your initial investment and trade in smaller “lots” with this platform. A reminder that the leverage is 1:500 for people outside the EU and ASIC regulation and 1:30 for those within those regions.

· Banking on Islam

XM is a significant player in the foreign exchange market around the world. The firm accommodates customers from all walks of life by providing a swap-free account, often known as an Islamic Forex trading account.

All of XM’s trading platforms can be adapted into an Islamic version. But before opening an Islamic account with a Forex broker, you should always contact them and explain your intentions.

In the foreign exchange market, “Islamic accounts” don’t allow interest to be accrued, collected, or paid. Because their owners are exempt from making swap payments, these accounts are called “swap-free.”

Do you think copy trading is a good fit for you?

Copy trading may seem like an excellent option for a trader with little experience but much to learn. You can save yourself a lot of time and effort by riding on the coattails of a successful investor rather than trying to study the market on your own. It’s hard to argue with that description. Try again.

Sure, luck could be on your side and bring you easy gains, but what if the trader you’re following is wrong? But what if they’re game-for chances you wouldn’t even consider? There is a chance that you could lose more money than you have available to you right now. The worst part is that if you blindly follow another trader and things go wrong, you may not know why.

In a nutshell, copy trading is fraught with peril, especially for inexperienced traders who lack the background knowledge to avoid common pitfalls.

Is Copy Trading Profitable?

If you can figure out which other trader you think will do well and then mimic their deals, you can make a lot of money with copy trading. However, even the most seasoned traders make mistakes and suffer losses from time to time. Systematic hazards might affect copy traders since the product they are trading could experience large price swings and rapid price reversals. The markets are notoriously volatile, and traders risk running out of money.

Copy trading is so risky because a trader’s success is highly dependent on the performance of the trader they select to copy. Successful investors often participate in trading groups, where they may learn from one another and get advice on which stocks to sell and which to buy.