Introduction to Bitcoin’s Price History

Bitcoin, the pioneering cryptocurrency, has captured the world’s attention since its emergence in 2009. As the first decentralized digital currency, Bitcoin has revolutionized the financial landscape and disrupted traditional systems. Understanding Bitcoin’s price history is crucial for investors and enthusiasts alike. By charting Bitcoin’s price journey over time, we can gain valuable insights into its market behavior, identify significant milestones, and make informed decisions. In this article, we will delve into the importance of charting Bitcoin’s price history and explore the key factors that have shaped its value.

Understanding Bitcoin’s Price Movements

Bitcoin’s price is influenced by a multitude of factors that drive its volatility. Understanding these dynamics is vital for comprehending Bitcoin’s price movements. Factors such as market demand, investor sentiment, regulatory developments, macroeconomic conditions, and technological advancements all play a role in shaping Bitcoin’s value. By analyzing Bitcoin’s price history, we can gain insights into how these factors have affected its market performance.

Tracing Bitcoin’s Price History

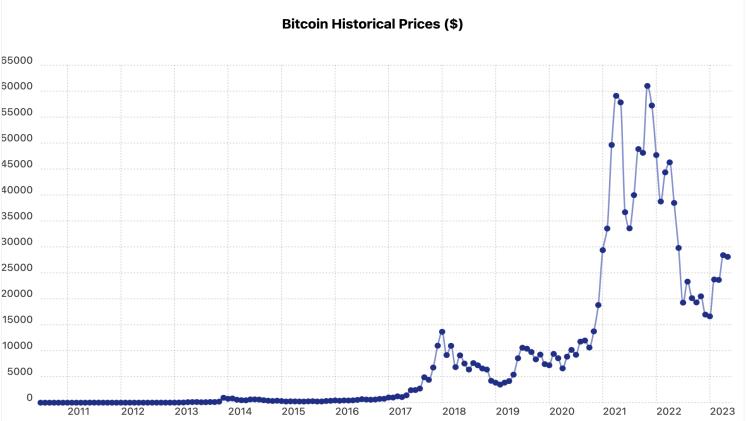

Let’s begin by examining the Bitcoin price history chart. This chart provides a comprehensive overview of Bitcoin’s price movements over a specific period, showcasing its growth and fluctuations. By observing the historical data, we can identify significant price movements, trends, and patterns that have characterized Bitcoin’s market performance.

| Date | Price | Open | High | Low | Vol. | Change % |

| Jun 23 | 25,839.3 | 27,216.4 | 27,410.2 | 25,425.6 | 681.08K | -5.06% |

| May 23 | 27,216.1 | 29,252.1 | 29,816.4 | 25,853.1 | 1.66M | -6.96% |

| Apr 23 | 29,252.1 | 28,473.7 | 30,964.9 | 27,054.3 | 2.03M | 2.73% |

| Mar 23 | 28,473.7 | 23,130.6 | 29,160.4 | 19,591.8 | 10.26M | 23.10% |

| Feb 23 | 23,130.5 | 23,124.7 | 25,236.8 | 21,418.7 | 9.09M | 0.02% |

| Jan 23 | 23,125.1 | 16,537.5 | 23,952.9 | 16,499.7 | 8.98M | 39.83% |

| Dec 22 | 16,537.4 | 17,163.4 | 18,351.8 | 16,331.2 | 6.61M | -3.65% |

| Nov 22 | 17,163.9 | 20,496.1 | 21,464.7 | 15,504.2 | 10.30M | -16.26% |

| Oct 22 | 20,496.3 | 19,422.9 | 21,038.1 | 18,207.9 | 8.29M | 5.53% |

| Sep 22 | 19,423.0 | 20,049.9 | 22,702.5 | 18,191.8 | 10.91M | -3.10% |

| Aug 22 | 20,043.9 | 23,303.4 | 25,205.7 | 19,542.9 | 6.55M | -13.99% |

| Jul 22 | 23,303.4 | 19,926.6 | 24,605.3 | 18,794.4 | 5.79M | 16.95% |

| Jun 22 | 19,926.6 | 31,793.1 | 31,969.9 | 17,630.5 | 3.79M | -37.32% |

The Bitcoin price history chart is a visual representation of Bitcoin’s market behavior over time. It reveals the journey from its early days, when the price was minimal, to the remarkable surges and corrections that followed. By studying this chart, we can identify key milestones and events that have shaped Bitcoin’s growth trajectory. This historical perspective allows us to understand the sentiment and market dynamics that influenced Bitcoin’s price at different points in time.

Key Milestones in Bitcoin’s Price Journey

Bitcoin’s price history is marked by several significant milestones and market developments that have had a profound impact on its growth and sentiment. These milestones include:

- Early Adoption and Market Awareness: The initial phase of Bitcoin’s price history witnessed low trading volumes and minimal market awareness. Bitcoin’s price remained relatively low during this period, with only a few early adopters recognizing its potential.

- Price Surges and Volatility: Bitcoin’s price experienced notable surges, leading to increased mainstream attention. Instances such as the 2013 rally, where Bitcoin surpassed $1,000 for the first time, and the historic bull run of 2017, when Bitcoin reached nearly $20,000, showcased the cryptocurrency’s potential for substantial gains but also highlighted its volatility.

- Regulatory Developments: The regulatory landscape has played a significant role in shaping Bitcoin’s price history. Government regulations, policy decisions, and legal frameworks have influenced market sentiment and Bitcoin’s acceptance by institutional investors.

- Market Corrections and Consolidation: Bitcoin’s price history also features periods of market corrections and consolidation. These phases allowed for price stabilization and the establishment of new support and resistance levels.

Understanding these key milestones and market developments is crucial for gaining insights into Bitcoin’s price behavior and assessing its potential future movements.

Analyzing Price Patterns and Trends

Bitcoin’s price history reveals various chart patterns and formations that can provide insights into future price movements. Common chart patterns include:

- Upward and Downward Trends: Bitcoin has experienced both upward and downward trends throughout its history. Identifying these trends helps traders and investors align their strategies with the prevailing market sentiment.

- Support and Resistance Levels: Price history enables us to identify key levels of support and resistance. Support levels act as price floors, where buying pressure is expected to prevent further price declines. Resistance levels act as price ceilings, where selling pressure typically emerges, hindering further upward movement.

- Reversal Patterns: Reversal patterns, such as head and shoulders or double tops/bottoms, can signal potential trend reversals. Recognizing these patterns can assist traders in identifying optimal entry or exit points.

Technical Indicators for Bitcoin Price Analysis

In addition to chart patterns, technical indicators play a crucial role in analyzing Bitcoin’s price trends. These indicators provide objective data points that help confirm or challenge price movements. Some popular technical indicators used in Bitcoin price analysis include:

- Moving Averages: Moving averages smooth out price fluctuations and help identify the underlying trend. Commonly used moving averages include the 50-day moving average (MA) and the 200-day MA.

- Relative Strength Index (RSI): RSI measures the strength and speed of price movements, indicating whether Bitcoin is overbought or oversold. It provides insights into potential price reversals.

- Bollinger Bands: Bollinger Bands consist of three lines plotted on the price chart. They help identify periods of high volatility and potential price breakouts or reversals.

Utilizing these technical indicators alongside chart patterns empowers traders and investors to make more informed decisions and better navigate Bitcoin’s market.

Interpreting Bitcoin’s Price History for Future Outlook

Charting Bitcoin’s price history and understanding its patterns, trends, and key milestones provides valuable insights for predicting potential future movements. By recognizing recurring patterns, understanding market cycles, and assessing market sentiment, traders can make more informed predictions about Bitcoin’s price direction. It is essential to combine historical analysis with fundamental research, market news, and risk management strategies to develop a comprehensive outlook.

Conclusion

Charting Bitcoin’s price history is a vital tool for understanding its market dynamics, identifying significant milestones, and predicting potential price movements. By analyzing historical data, recognizing price patterns and trends, and utilizing technical indicators, traders and investors can gain valuable insights into Bitcoin’s market behavior. It is crucial to approach Bitcoin trading and investment with a well-informed strategy, risk management practices, and a long-term perspective. By leveraging historical analysis and staying informed about market developments, we can navigate the cryptocurrency landscape with confidence and maximize our understanding of Bitcoin’s price trends.